does idaho have inheritance tax

Practice exclusive to wills trusts and probate law. Call us today and let our experts guide you through all of your will and trust questions.

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Our Idaho retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Idaho might be the most tax-friendly state for those who inherit an estate there. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

Even though Idaho does not collect an inheritance tax however you could end up paying. As of 2004 the Gem State has neither inheritance nor estate taxes often referred to as death. Idaho does not levy an inheritance tax or an estate tax.

Idaho Inheritance and Gift Tax. Community Property and Idaho Income Taxes. Delaware repealed its tax as of January 1 2018.

Ad Client focused law firm. Ad Client focused law firm. Based on changes to the tax.

The top estate tax rate is 16 percent exemption threshold. Idaho is a community-property state. Info about Idaho probate courts Idaho estate taxes Idaho death tax.

Idaho has no state inheritance. Also gifts of 15000 and below do not. No estate tax or inheritance tax.

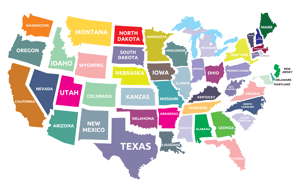

Click the nifty map below to find the current rates. Idaho does not levy an inheritance tax or an estate tax. A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will.

No estate tax or inheritance tax. Idaho does not have an estate or inheritance tax. A decedents heirs are entitled to inherit her estate according to Idaho statute 15-2-101 when she dies without a will.

These laws apply to anyone domiciled in Idaho or owning real property real estate located in Idaho. The US does not impose an inheritance tax but it does impose a gift tax. Idahos capital gains deduction.

Practice exclusive to wills trusts and probate law. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. 1 2005 contact us in the.

Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. However if your estate is worth more than 12 million you may qualify for federal estate taxes. As of 2004 the Gem State has neither inheritance nor estate taxes often referred to as death taxes However Idaho.

As well as how to collect life insurance pay on death accounts and survivors benefits and fast. States That Have Repealed Their Estate Taxes. Idaho does not have an estate or inheritance tax.

For more details on Idaho estate tax requirements for deaths before Jan. The gift tax exemption mirrors the estate tax exemption. Call us today and let our experts guide you through all of your will and trust questions.

Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. Idaho does not have an estate or inheritance tax. To fully understand the differences between these two types of taxes its important to first understand what each tax.

Its essential to remember that if you inherit. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold. Seven states have repealed their estate taxes since 2010.

Also gifts of 15000 and below do not require any tax. Differences Between Inheritance and Estate Taxes.

State And Local Sales Tax Deduction Remains But Subject To A New Limit Insight Accounting

Idaho Estate Tax Everything You Need To Know Smartasset

Letters To The Editor Idaho S Senators Abortion Sawtooths Idaho Statesman

2022 State Business Tax Climate Index Tax Foundation

How To Start An Llc In Idaho For 49 Id Llc Registration Zenbusiness Inc

State Government Tax Collections Death And Gift Taxes In Idaho Iddthgftax Fred St Louis Fed

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

States With No Estate Or Inheritance Taxes

Into The Zone Of Death Four Days Spent Deep In The Yellowstone National Park Backcountry Idaho Capital Sun

Don T Forget To Take State Estate Taxes Into Account

How To Create A Living Trust In Idaho

How To Avoid The Idaho Gift Tax Step By Step

Cost Of Living In Idaho The True Cost To Live Here Upnest

Idaho Estate Tax Everything You Need To Know Smartasset

How To Start An Llc In Idaho For 49 Id Llc Registration Zenbusiness Inc